Morning View

In the United States, indices rose yesterday ahead of Nvidia's results

International

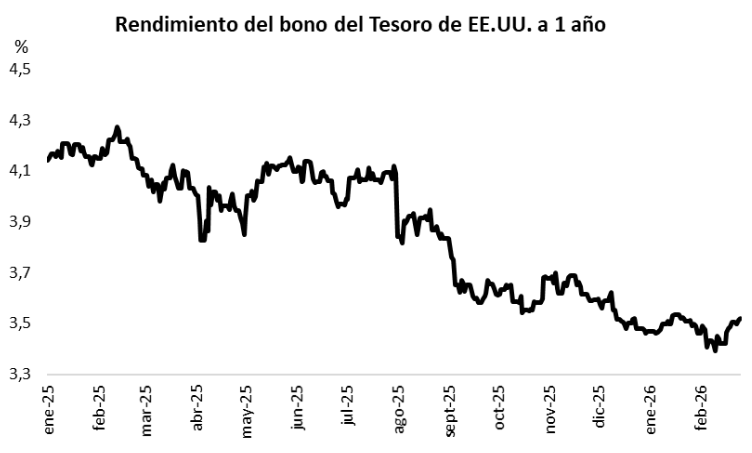

In the United States, the main stock indices advanced on Wednesday. The S&P 500 gained +0.8%, while the Nasdaq advanced +1.3% and the Dow Jones +0.6%. So far this year, they have accumulated variations of +1.5%, -0.4%, and +3.0%, respectively.

Yesterday, semiconductor company Nvidia presented its results for the fourth quarter of 2025. In terms of revenue, the company reported USD 68.1 billion, above the USD 65.56 billion projected by the analyst consensus. Earnings per share (EPS) reported for the quarter were $1.62, also exceeding the $1.52 projected. The stock is up about 1% in pre-market trading.

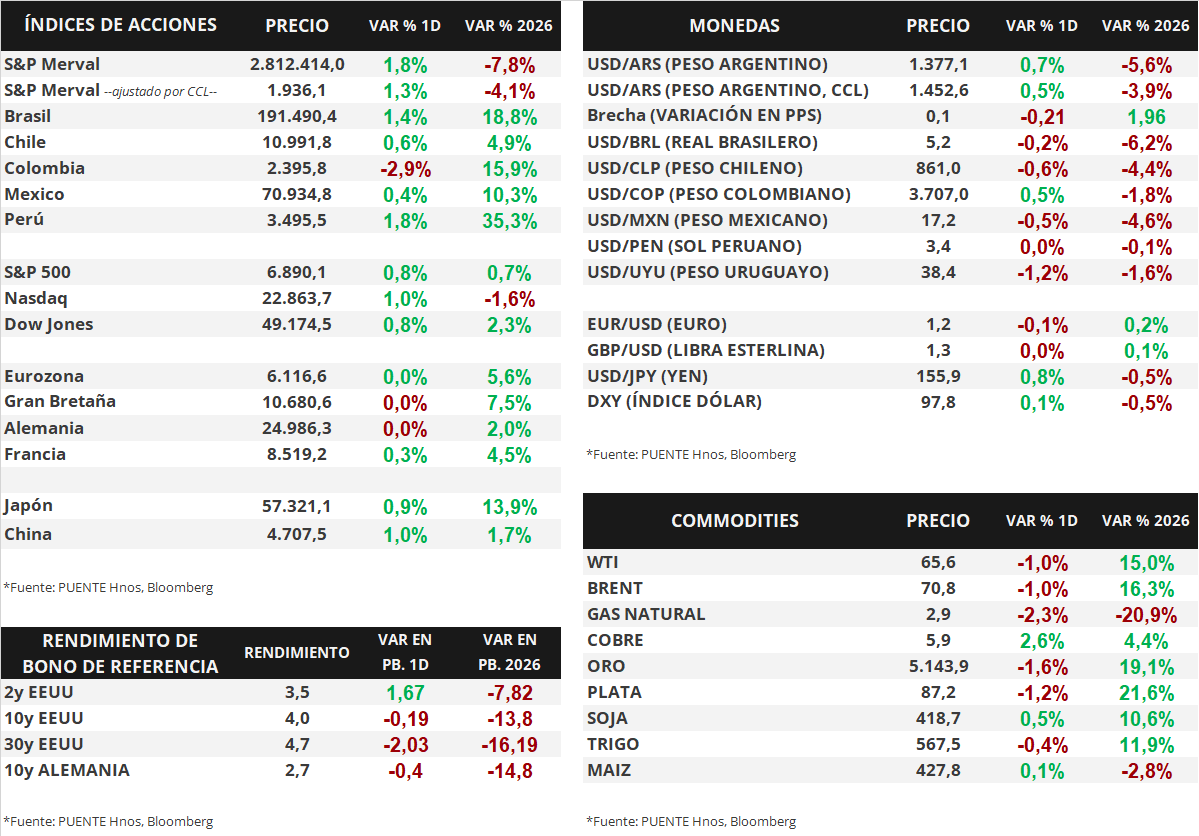

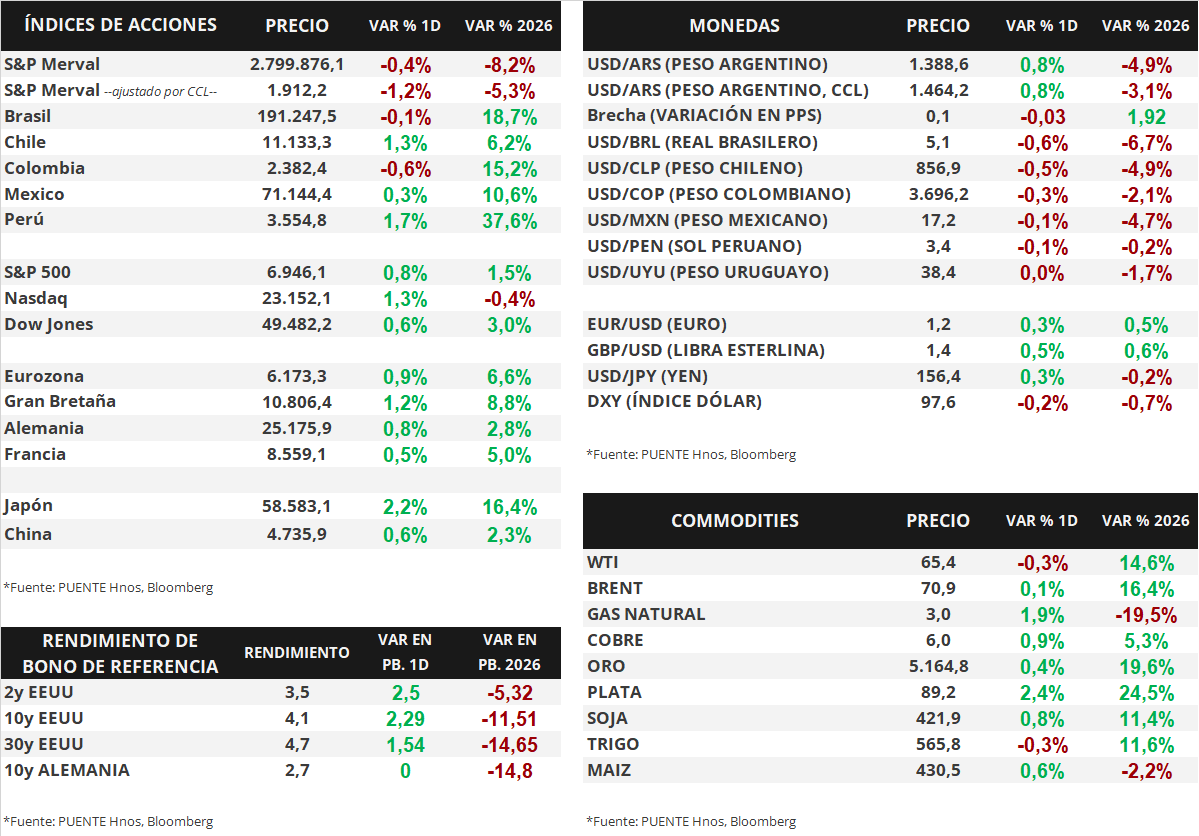

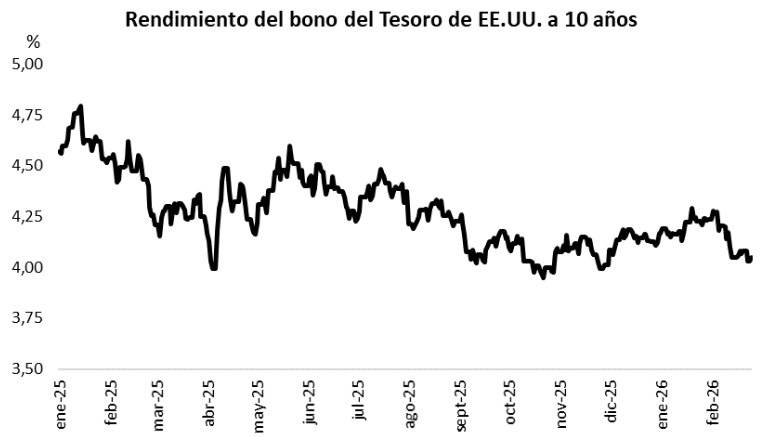

As for U.S. Treasury bond yields, the curve widened again yesterday. The 1-year bond yield rose from 3.51% to 3.52%, while the 3-year bond yield rose from 3.46% to 3.49%. Meanwhile, the 10-year bond yield rose from 4.03% to 4.05%.

Source: PUENTE Hnos, Bloomberg

Consumer confidence surprises on the upside in February

International

In the United States, yesterday saw the publication of consumer confidence data measured by The Conference Board. In February, this indicator stood at 91.2 points, above the 87.1 projected by the consensus of analysts, and also exceeding January's measurement of 89 points.

Yesterday, the main US stock indices advanced during trading. The S&P 500 gained +0.8%, while the Nasdaq advanced +1.0%, and the Dow Jones also rose +0.8%. So far in 2026, the indices have accumulated variations of +0.7%, -1.6%, and +2.3%, respectively.

As for US Treasury bond yields, the curve widened slightly yesterday. The 1-year bond yield rose from 3.50% to 3.51%, while the 3-year bond yield rose from 3.44% to 3.46%. Meanwhile, the 10-year bond remained unchanged at 4.03%.

Finally, January inflation figures were published in the Eurozone. The consumer price index fell -0.6% in the month, slightly below the -0.5% expected by the consensus of analysts. In year-on-year terms, the measurement was +1.7%, in line with expectations. The core measurement, which excludes food and energy, was also in line with projections, at +2.2% year-on-year.

Source: PUENTE Hnos, Bloomberg